Accounts payable aging reports help you track how much you owe vendors and when those payments are due. This info is useful for:

- Prioritizing payments to take advantage of early payment discounts or avoid late fees.

- Planning your cash flow to ensure you have enough money to cover upcoming bills.

- Identifying overdue invoices and investigating any discrepancies.

These reports can also be used for:

- Cash flow forecasting: predict future needs based on upcoming payments.

- Vendor negotiations: use your payment history to negotiate better terms.

- Internal control: identify inefficiencies in your accounts payable processes.

Here are some stats:

Companies with effective AP management can reduce their accounts payable costs by 10-20%, and accurate AP aging data can provide insights for strategic decisions, leading to 10-15% better financial outcomes. This is why the global spend analytics market size was valued at USD 2.53 billion in 2023 and is estimated to reach USD 11.52 billion by 2032, growing at a CAGR of 18.35% during the forecast period (2024–2032).

In this article, we will talk about what the accounts payable aging report is, what its purpose is, why it’s important, and provide a template for it.

What is an accounts payable (AP) aging report?

The accounts payable aging report shows you a complete list of all invoices that you have not yet paid, minus any credit notes that you have not yet credited. It’s an important accounting document that summarizes a company’s invoices and bills by vendor and due date. A detailed AP aging report shows invoices with reference number, payment date, payment periods, and outstanding balance. The opposite of the accounts aging report is the accounts receivable report, which tells when a company can expect payments from its customers.

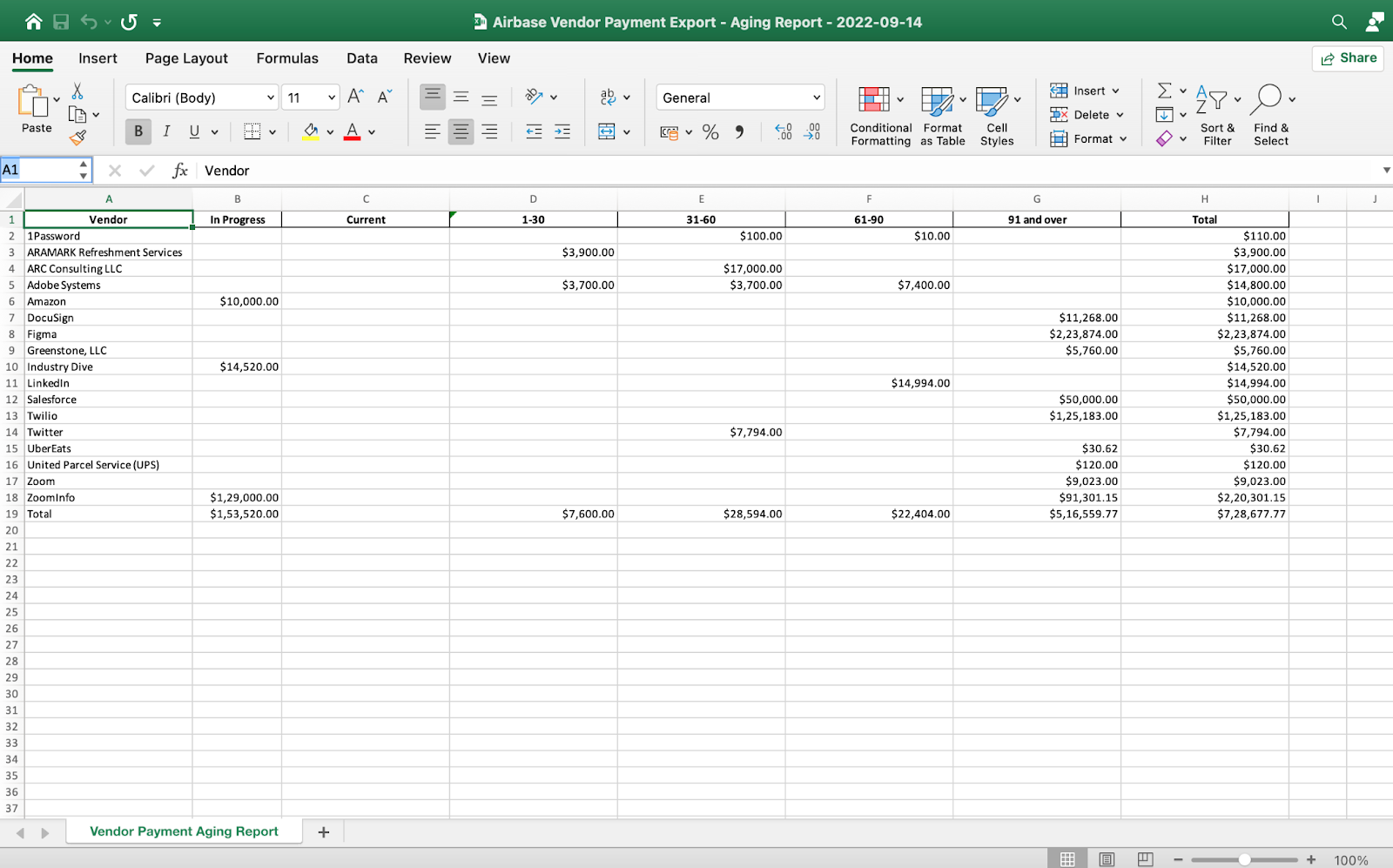

Get your free Excel template for the accounts payable aging report.

This Excel template provides a framework for creating your own accounts payable aging report.

This report provides a clear picture of your outstanding payments to a specific vendor. Here’s a breakdown of what each section means:

Vendor: This displays the name of the vendor you owe money to.

Payment status:

- In progress: Payments in transit: This section shows any payments currently being processed for this vendor. These payments haven’t yet reached the vendor’s account.

- Current: This section lists invoices with due dates falling after the “Age As Of” date on the report. These invoices are not yet overdue.

Aging buckets:

- 1–30 days, 31–60 days, 61–90 days, 91 days and over: These sections categorize outstanding invoices based on how long they’ve been overdue. The first number indicates the minimum number of days past due date, and the second indicates the maximum. For example, the “31–60 days” bucket includes invoices overdue between 31 and 60 days (inclusive).

Total: This section displays the total amount you currently owe the vendor, including outstanding invoices and payments in transit.

Multi-subsidiary aging reports: This section provides additional details for companies with multiple subsidiaries. It can show either:

- Details for each subsidiary: This breaks down the vendor’s outstanding balance and aging buckets for each individual subsidiary.

- Aggregate view for all subsidiaries: This provides a combined view of the vendor’s outstanding balance and aging buckets across all subsidiaries.

Vendor credits: This section accounts for any credits you may have received from the vendor. Here’s how it works:

- Due date: For vendor credits, the Due Date reflects the Credit Date, which is the date the credit was issued.

- Age: The age of a vendor credit is calculated based on the Credit Date.

- Bill currency opening balance: For vendor credits, this shows the amount of the credit as of the “Age As Of” date on the report.

- Bills paid with vendor credits: Invoices settled partially or fully using vendor credits are included in the report.

- Fully applied vendor credits: If a vendor credit has been entirely used to pay off an invoice, it won’t be listed in the aging buckets.

What’s the purpose of an accounts payable aging report?

The purpose of an accounts payable aging report goes beyond simply tracking invoices; it serves as a vital gauge of your company’s financial health and its relationship with vendors.

Effective management of vendor relationships is a cornerstone of any financially sound business. A critical tool in this endeavor is the accounts payable aging report.

You can use the report to find out how much money you owe at one time and how long it has taken you to process those payments.

Adjust rates: Some providers offer attractive early payment discounts, while others charge upfront fees. Old reports will help determine the number of first payments. That way, you won’t lose savings or incur unnecessary penalties.

Monitor cash flow: Knowing when your invoices are due can help you predict your cash flow needs. This will help you plan future payments and avoid unexpected financial burdens. The old report shows upcoming due dates, allowing you to anticipate these events and make sure you have ready funds to meet your financial obligations.

Identify potential issues: Reports help you identify overdue invoices that may have been lost in the shuffle. This helps identify potential issues with suppliers and internal processes before they become a major problem. For example, a report might show overdue invoices from a supplier you paid earlier. This may indicate that the supplier is providing duplicate invoices, goods, and services not provided as agreed, or internal processing errors.

Benefits of an accounts payable aging report.

Benefits of AP aging reports include:

- Ability to review the report prior to payment for potential errors such as duplicate invoices.

- Planning and scheduling vendor invoices for payment dates for cash flow and required financing.

- Save money by identifying prepayment discounts and avoiding late payments.

- Use accounts payable balances and cash flow forecasting in your business plan.

- Achieve greater accuracy by matching vendor AP age balances with vendors received and general ledger.

AP Automation Tour

Explore 3-way matching in our AP Automation Product tour.

What data do you need to prepare in an accounts payable aging report?

An accurate and informative accounts payable aging report requires compiling specific data points. This information provides a clear picture of your outstanding vendor obligations and empowers you to make informed financial decisions. Here’s a breakdown of the essential data elements needed for your report:

- Vendor information: This section serves as the foundation of your report, identifying the specific vendors to whom you owe money. It typically includes:

- Vendor name: The legal name of the vendor you are indebted to.

- Account number (optional): A unique identifier assigned by your company to the vendor account, facilitating internal record-keeping.

- Contact information (optional): Contact details like email address or phone number for the vendor, potentially useful for resolving discrepancies or expediting payments.

- Invoice details: This section delves into the specifics of each outstanding invoice. It provides a granular view of your liabilities and helps identify potential issues. Key details typically include:

- Invoice number: A unique identifier assigned by the vendor to the specific invoice.

- Invoice date: The date the invoice was issued by the vendor.

- Due date: The date by which full payment is expected by the vendor.

- Original invoice amount: The total amount billed by the vendor for the goods or services provided.

- Payment terms (optional): The specific payment terms offered by the vendor, such as net 30 days or early payment discounts.

What’s included in an accounts payable aging report?

The aging report includes details of the balance you owe the vendor based on the duration that the bills have been unpaid.

A detailed accounts payable aging report lists the outstanding invoices for each supplier. Each invoice line displays the invoice number, invoice date, payment terms, and payment date data based on the payment terms. It may also indicate a purchase order (PO) number or another type of document reference number, such as a credit memo number associated with an invoice.

The accounts payable aging report contains an aggregate of all vendor accounts payable and column totals for each aging period using the current period and days to come. The totals appear in the columns at the bottom of the aging report and the total column on the right, which calculates the sum of the remaining columns for all days.

Generating and reading your report.

The good news is that you don’t have to be a financial whiz to understand accounts payable aging reports. Most accounting software can generate these reports automatically on a monthly or even daily basis.

Here’s a quick guide on how to read your report:

- Total outstanding balances: Start by looking at the total amount you owe to each vendor. This gives you a quick overview of your overall vendor debt.

- Due date ranges: Pay attention to the aging buckets. See which vendors have invoices approaching due dates or are already overdue. This helps you prioritize payments and avoid late fees.

- Early payment discounts: Identify any vendors offering early payment discounts. By strategically paying these invoices sooner, you can save your company money.

- Investigate overdue invoices: For invoices that are significantly overdue, it’s wise to investigate the reason. Did the vendor send a duplicate invoice? Are there any discrepancies in the amount or service provided?

Which transactions are reflected in an accounts payable aging report?

An accounts payable aging report reflects three types of transactions in the calculation of outstanding accounts payable balances requiring payment:

- Vendor bills invoicing your business as a customer for purchases.

- Vendor credit memos (for returned or damaged items or price corrections).

- Invoice payments made to vendors.

How to prepare an accounts payable aging report.

Step 1: Aggregate your invoices and invoice data.

- Invoices: Collect all your outstanding invoices. This can be done automatically if you use an accounting software like Airbase, or manually if you have paper invoices.

- Vendor information: Make sure you have details for each vendor you owe money to, including their names, account numbers, and contact information.

- Invoice details: For each invoice, you’ll need specific information such as:

- Invoice number: This allows you to easily reference the original invoice for details.

- Invoice date: The date the invoice was issued by the vendor.

- Due date: The date by which full payment is expected to the vendor.

- Original invoice amount: The total amount initially billed by the vendor.

- Payments made (if any): If partial payments have been made on the invoice, record the amount(s) and date(s) of each payment.

Step 2: Define your aging periods.

This step is crucial for categorizing your outstanding invoices and analyzing your payment trends. Aging periods essentially create time buckets that categorize invoices based on how long they’ve been overdue. Here’s what you need to consider when defining your aging periods:

- Industry standards: Different industries may have standard aging periods they typically use. Research common practices in your field for a starting point.

- Company payment terms: Consider your typical payment terms offered to vendors. For example, if you often offer net 30-day terms (meaning full payment is due 30 days after the invoice date), you might want your first aging bucket to reflect invoices due within the next 30 days (current).

- Risk management: Early identification of overdue invoices helps manage potential late payment penalties and strained vendor relationships. You might want to have a shorter aging bucket for invoices that are only slightly overdue to address them promptly.

- Internal needs: Ultimately, tailor your aging periods to best suit your company’s needs for financial analysis and risk assessment.

Step 3: Organize your invoices by due date.

After gathering all your invoice information, sort them chronologically by their due dates. This will give you a clear picture of which invoices need to be paid first.

Step 4: Categorize invoices into aging buckets.

Common aging buckets are:

- Current: Due immediately (0 days past due).

- 1-30 days past due date.

- 31-60 days past due date.

- 61-90 days past due date.

- 90+ days past due date.

You can adjust these ranges based on your company’s needs. Assign each invoice to the appropriate aging bucket based on how many days it’s been past due.

Step 5: Calculate totals for each aging period.

For each aging bucket, add up the total amount owed to vendors. This will show you the overall breakdown of your outstanding accounts payable and how much is overdue in different timeframes.

Commonly asked questions and challenges with AP aging reports.

Understanding how to use and interpret an accounts payable aging report is essential for any business. Here are some frequently asked questions and challenges you might encounter:

Why is an accounts payable aging report needed for an audit?

An accounts payable aging report is a vital document during an audit. It helps auditors verify the accuracy of your accounts payable records and ensure all outstanding invoices are properly recorded and categorized. The aging report provides a clear breakdown of your liabilities, helping auditors assess your financial health and potential risks associated with overdue payments.

How do you read an AP aging report?

An AP aging report typically includes columns for vendor names, invoice details, and aging buckets (e.g., current, 1-30 days past due, etc.). Look for the total amount owed to each vendor and how much falls into each aging bucket. This helps you identify overdue invoices and prioritize payments based on their age.

What is the difference between an AP aging report and an AR aging report?

An accounts payable (AP) aging report focuses on what your company owes to vendors. It categorizes outstanding invoices based on how long they’ve been overdue. Conversely, an accounts receivable (AR) aging report shows how much money customers owe your business. It categorizes unpaid customer invoices by their due date.

What does a negative amount on the accounts payable aging report indicate?

A negative amount on an AP aging report is typically an error. It could indicate a prepayment made to a vendor or an outstanding credit memo that needs to be applied to the invoice amount. Investigate the source of the negative amount to ensure your report reflects accurate data.

How do I create an accounts payable aging report in QuickBooks?

Most accounting software, including QuickBooks, allows you to generate AP aging reports. The specific steps may vary depending on your software version. However, you’ll typically find the report generation option within the accounts payable section of your software. Consult your QuickBooks user manual or online resources for specific instructions on generating AP aging reports in your version.

Challenges with AP aging reports:

- Data accuracy: Ensure the accuracy of your underlying invoice data to generate a reliable report.

- Timeliness: Regularly update your report to reflect current accounts payable data.

- Customization: Adapt the report format and aging periods to fit your company’s specific needs.

Summary: The power of aging report.

Accounts payable aging reports offer a wealth of benefits beyond simply tracking outstanding bills. Here are some additional ways you can leverage these reports:

- Cash flow forecasting: By analyzing your aging report trends, you can forecast your future accounts payable needs. This helps you plan for upcoming payments and ensure you have sufficient cash flow to meet your obligations.

- Vendor negotiations: The report can be a valuable tool when negotiating payment terms with vendors. By knowing your average payment turnaround time, you can negotiate for extended payment terms without impacting your vendor relationships.

- Internal control: Regularly reviewing aging reports helps identify any errors or inefficiencies in your accounts payable processes. This can lead to improvements in invoice processing and payment procedures.

Airbase’s automated accounting creates real-time exportable accounts payable aging reports. Not just that, you can view a detailed audit trail of every bill — when it was uploaded, approved, and paid, see completed and pending bill payments for vendors during bill creation to avoid duplicate payments, have the option to invite vendors and have them provide their payment and tax details through the vendor portal, and allow vendors to upload invoices and track the status of their payments.

Book a demo to know why Airbase is a G2 Leader in AP Automation and Procure-to-Pay, and also earned the #1 position on the Usability index.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana