FINANCE, ACCOUNTING, & PROCUREMENT COMMUNITY

Off the Ledger.

Join your peers.

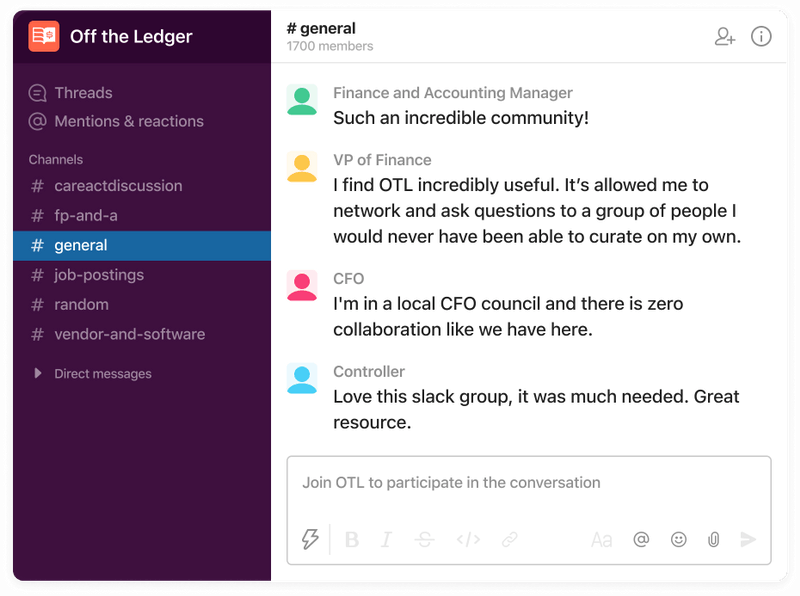

Over 5,000 finance, accounting, & procurement professionals, connected through Slack.

A community where members ask questions, give advice, network, and keep up to date on what’s happening in finance and accounting. The forum is a protected no-sales zone.

Already an Off the Ledger member?

Open the Off the Ledger Slack group on your desktop or in your browser.

We’re kind of exclusive.

We have a simple application process to ensure that only finance, accounting, and procurement professionals are brought into the community.

Looking forward to seeing you in the group!

Off the Ledger Slack Group for finance and procurement.

Community guidelines.

Community guidelines.

Be professional & courteous.

Treat other members with respect and help each other. It’s “accrual” (get it?) world out there. Speak to others the way you’d like them to speak to you. Help us keep OtL as accessible and inclusive as possible.

No sales allowed.

Please do not use the group to advertise, solicit sales, or perform customer research. This includes public and private channels as well as direct messages. Please report any questionable activity to an OtL admin (like Darragh).

Keep it Off the Ledger.

The group is a safe space for finance leaders to gather and have candid discussions about work. Please keep conversations private and do not share discussions outside of the group.

Introduce yourself.

Set your display name to First Name Last Name (companydomainname.com). For example Bill Gates (microsoft.com), and say hi to the group in #1-introductions!

Engage.

This is your community. Ask and answer questions, engage in conversation, be helpful to other members, and show your appreciation when they are helpful to you. Try to post conversations to the right channel so that they can be more easily discovered by others.

Share your experience.

This community is a place for finance professionals to gather and help one another. Make the most of it for your purposes and invite others that you know to apply to join. Please participate and make the group even better for everyone. You can recommend a friend or colleague join the group by sending them this application.

Ask for help.

Facing a challenging problem at work, or just looking for recommendations? Ask the group! Your comments and concerns are more likely to be seen if you post to specific channels. All things CARES Act in #caresactdiscussion, vendor and software questions in #vendors-and-software, financial planning and analysis in #fp-and-a, and all other queries in #general.

Jira

Jira  Ironclad

Ironclad  Asana

Asana