In this guide, we delve into the core of P2P, exploring its benefits for organizations, the software solutions that streamline the process, and best practices to overcome challenges. From simplified procurement processes to better control over spending and timely payment processing, each step offers insights into a system designed for efficiency and transparency. Here we take a deep dive into the P2P process, unravel its software intricacies, and present you with the key steps and best practices that pave the way for successful procurement management.

We’ll also take a look at how P2P is shifting from exclusively a centralized procurement function supported by legacy software to newer approaches that focus on P2P for decentralized spending.

What is procure-to-pay?

The procure-to-pay (P2P) process encompasses the entire lifecycle of purchasing goods and services from external vendors and is by its nature a cross-functional one. It includes identifying and sourcing suppliers, negotiating contracts, placing orders, receiving goods and services, and processing invoices and payments. P2P plays a pivotal role in ensuring that purchase requisition orders are compliant. It is the process by which organizations ensure cost control and maintain vendor relationships.

How P2P software can benefit your organization.

Simplified procurement processes.

The P2P process is a complex one involving several stakeholders and various processes in an organization. Software can streamline and simplify procurement by creating an end-to-end workflow in one cohesive system. This approach automates and standardizes purchasing activities, making it easier to request, order, pay for, and receive goods or services.

P2P software can:

- Enhance visibility.

- Reduce manual tasks.

- Enforce policy compliance.

- Reduce errors.

- Improve vendor relations.

- Lead to better cost control.

- Improve visibility into financial status.

As a result, P2P ultimately simplifies the entire process and ensures more cost-effective and streamlined procurement management.

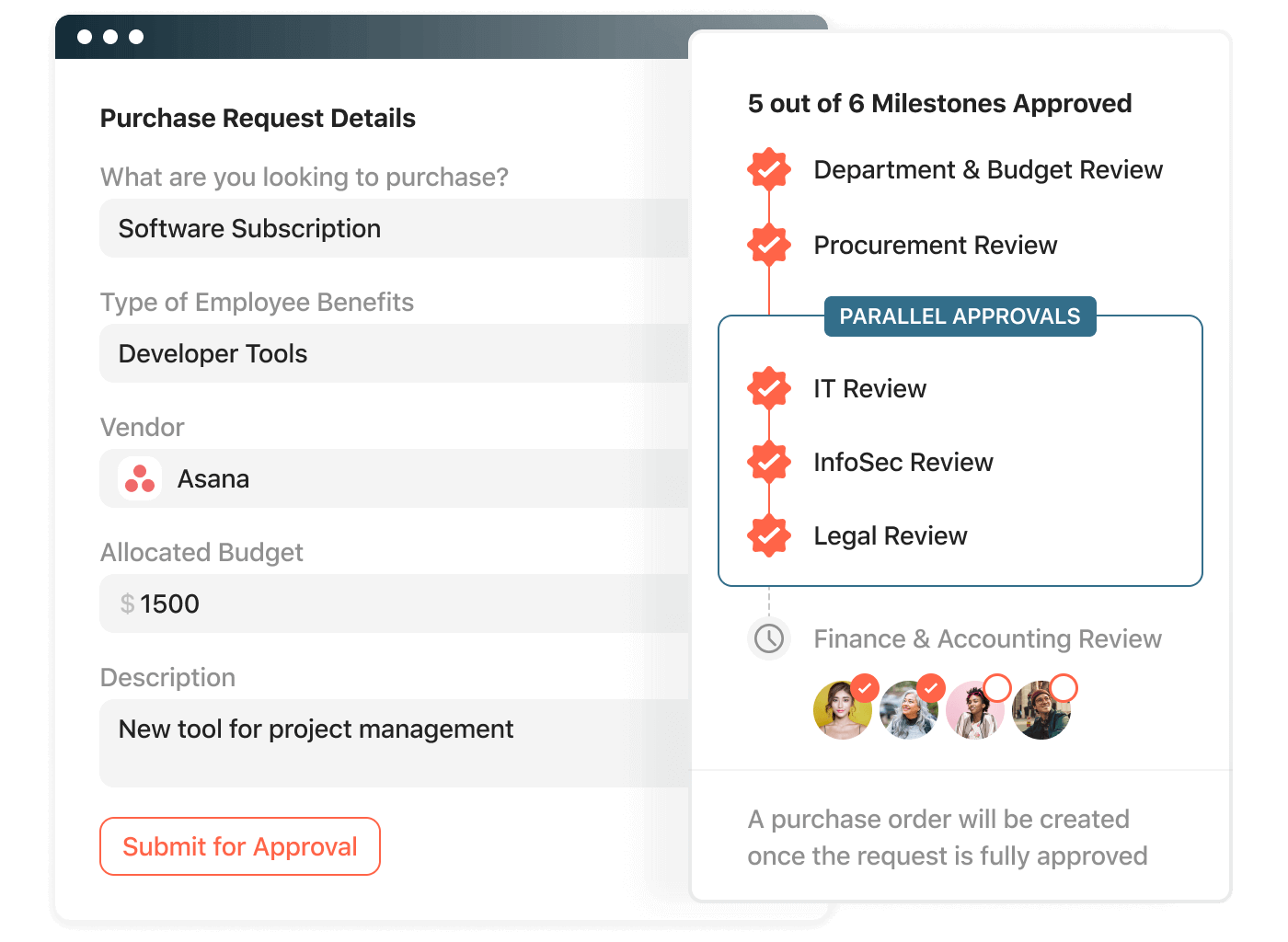

The image below shows a request to make a software purchase in Airbase. All stakeholders have visibility into what is being requested, the details provided, and who is needed to review and approve.

Better control over spending.

The procure-to-pay process empowers organizations with heightened control over spending by establishing standardized procedures and automated workflows. P2P ensures that every purchase is aligned with predefined policies and is approved by the appropriate stakeholders.

It also offers real-time visibility into the entire procurement cycle — from requisition to payment — allowing organizations to monitor and analyze spending patterns, identify cost-saving opportunities, and maintain accurate financial records.

This granular control and transparency not only enhances spend management, but also enables businesses to make informed decisions, strengthen vendor relationships, and optimize procurement strategies.

Timely payment processing.

The procure-to-pay process leads to more timely payment processing through its efficient automation and streamlined workflows. By digitizing and standardizing procurement and invoice approval processes, this P2P cycle reduces manual tasks and paperwork, ensuring that invoices are processed promptly.

It also enables quick validation and matching of invoices to purchase orders and receipts, which accelerates the approval cycle. By minimizing delays, organizations can make payments on time, building stronger vendor relations and avoiding late fees or disruptions in the supply chain.

Increase in compliance.

P2P processes play a pivotal role in ensuring adherence to both organizational and regulatory standards. By incorporating standardized procedures, automated workflows, and predefined policy compliance checks, P2P mitigates the risk of non-compliance.

Airbase automatically creates an airtight audit trail for every transaction, including approval records, receipts, and related documentation like contracts. This provides a real-time record of compliance in the event of an audit.

Tour Guided Procurement

Click through our interactive demo to experience seamless collaboration for all stakeholders.

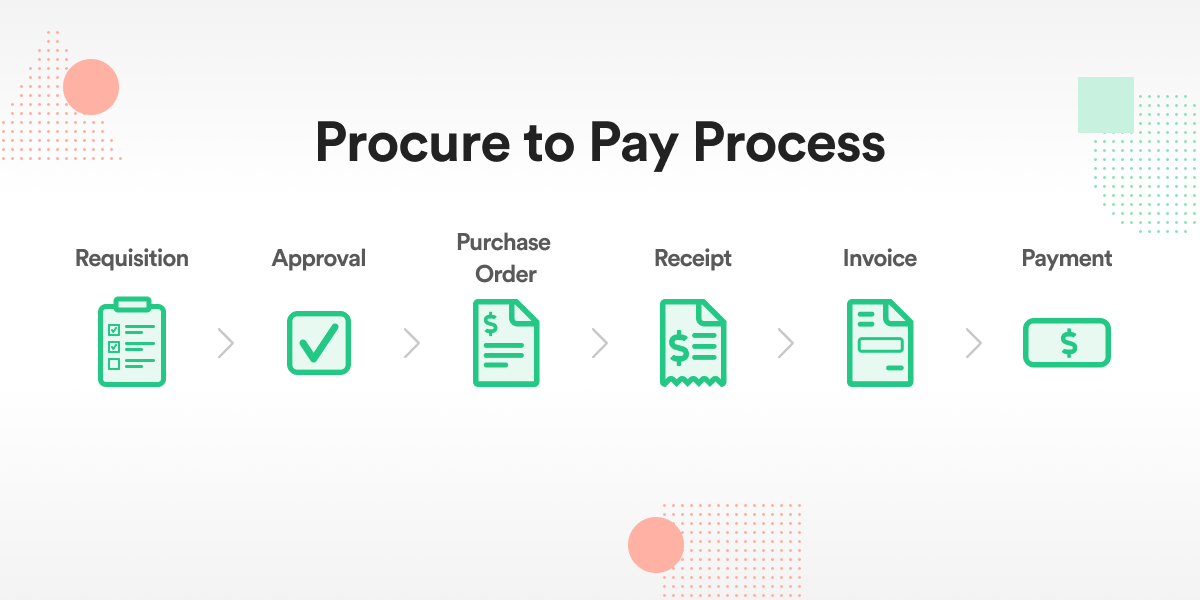

The steps of the procure-to-pay process.

Here is a sequential breakdown of the steps involved in procurement.

Step 1: Identifying the need.

Accurate identification of an organization’s needs not only helps in cost control and budget management but also prevents unnecessary expenditures. Timely identification of these needs helps streamline procurement processes, ultimately enhancing operational efficiency. These needs are typically identified in the budgeting process, which means that procurement benefits from being tied back into budgets as purchases are made.

Step 2: Finding suppliers.

Procurement teams are experts at finding suppliers for the key goods and services that go into their product. They will often rely on a Request for Proposal or a Request for Quote process, where requirements are submitted to a list of suppliers to compare prices and capabilities. In addition, the teams that are going to use the product or service (say a software product) will have opinions and knowledge about which suppliers will be best. This approach is called bottom-up software buying and is relied upon in most organizations for a significant number of purchases.

Step 3: Raising purchase orders.

After selecting a supplier, the person making the purchase generates a formal purchase order (PO). This legally binding document outlines the terms and conditions of the purchase, including the items ordered, quantities, prices, delivery dates, payment terms, and supplier contact information.

Step 4: Receiving goods or services.

Once the goods or services are received, the procurement team or designated personnel inspect them to ensure they meet the specifications outlined in the PO. Any discrepancies or defects are documented and communicated to the supplier for resolution.

Step 5: Invoice reconciliation and approval.

After verifying the goods or services, the supplier submits an invoice for payment. The procurement team reviews the invoice against the PO and initiates the payment process.

Step 6: Payment to suppliers.

Payment methods may include electronic transfers, checks, or credit cards. Payments are made to the supplier according to the terms in the PO or formal contract. A vendor portal allows suppliers to track payment information and can save accounting teams time responding to questions. Vendors can also use it to update information like changes to banking details, W-9 submissions, and documentation updates.

Step 7: Close the loop.

“Closing the loop” in P2P refers to the final stage of completing the procurement cycle and ensuring that all outstanding tasks and obligations have been addressed. It involves reconciling invoices, making payments to suppliers, and recording the transactions in the company’s accounting system.

Closing the loop is crucial for maintaining accurate financial records, ensuring supplier satisfaction, and preventing potential financial discrepancies or legal issues. It helps to streamline the P2P process, improve efficiency, and minimize the risk of errors or omissions.

We include this step since it is generally included in P2P discussions. However, modern P2P systems include these steps in the overall flow and would not necessarily identify closing the loop as an independent step.

Step 8: Reporting and analytics.

Reporting and analytics play a pivotal role in continuous P2P improvement, serving as the compass that guides organizations to their efficiency and savings goals. By analyzing transactional data, organizations can identify patterns, bottlenecks, and opportunities for optimization. Accurate reporting ensures key stakeholders have access to real-time data for informed decisions.

Demo Airbase today.

Learn how Airbase can increase your spend under management.

What is P2P software?

Procure-to-pay (P2P) software is a comprehensive suite of tools that automate and streamline the entire procurement process, from requisitioning goods and services to paying suppliers. It helps businesses manage their spending, improve efficiency, and achieve greater control over their supply chains. The P2P software landscape is rapidly changing as newer solutions offer mid-market and early-enterprise companies a less cumbersome alternative to legacy software.

What should I look for in a P2P solution?

It is important to find the P2P software that is the right fit for your organization. Traditional P2P software is built to meet the needs of manufacturing companies with a heavy emphasis on supplier analysis and supply chain implications of a purchase. New P2P systems tend to focus more on purchases for goods and services that do not involve strategic sourcing, formalized requests for proposals (RFPs), and ongoing supply chain management needs.

Purchase order management is a core feature of P2P software. It allows organizations to create, manage, and track POs.

Invoice processing streamlines the verification, validation, and payment of invoices. It should include automatic data capture, the ability to match POs to receipts and invoices, and a workflow for approval.

Supplier management is crucial for maintaining vendor information, performance metrics, and collaboration. Effective supplier management helps strengthen vendor relationships.

Spend analysis provides insights into how an organization is spending its money.

Reporting and analytics enable organizations to gain actionable insights into their procurement activities.

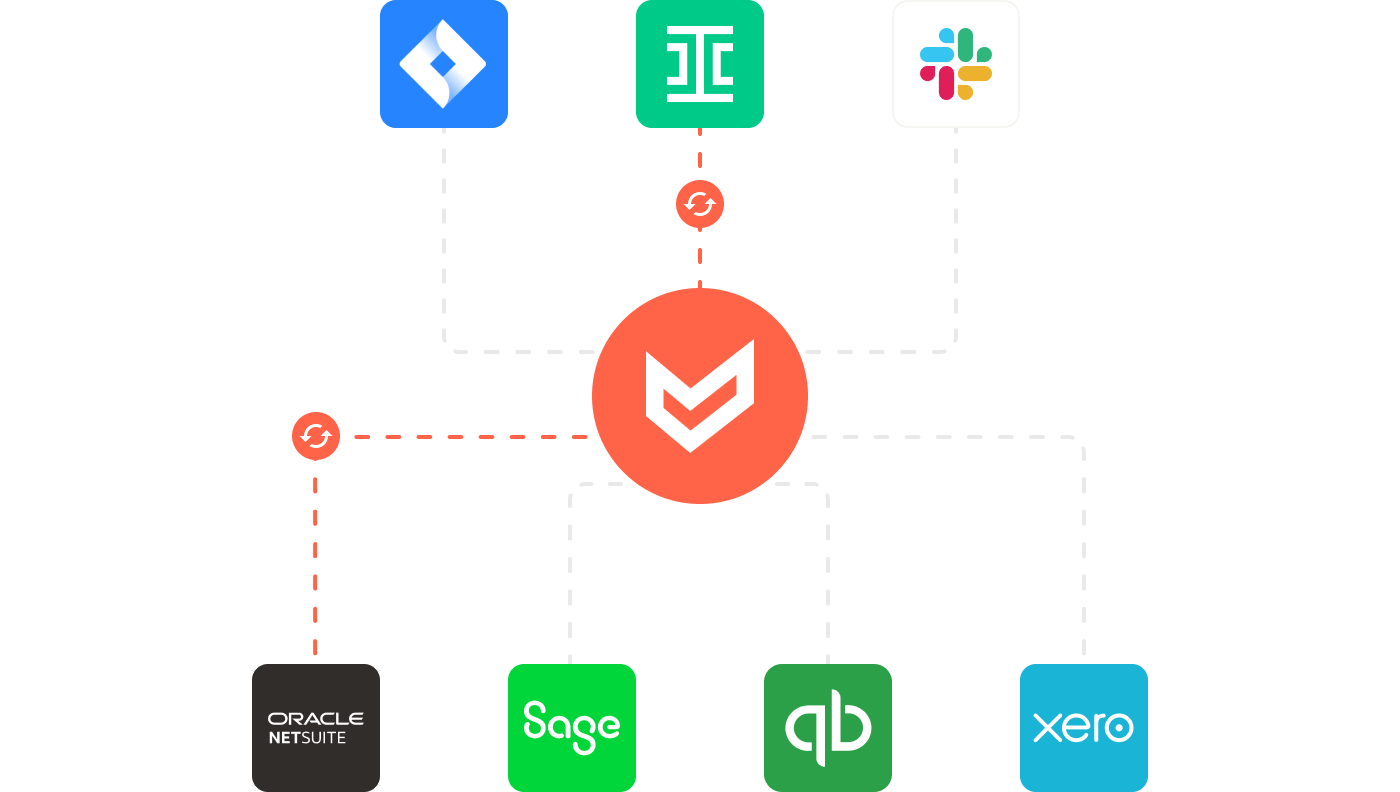

Integrations are crucial for connecting P2P software with other systems, such as the ERP. This ensures a seamless flow of data for effective spend management.

Security is paramount for P2P software. It should offer access controls and compliance with data protection regulations.

User-friendliness is essential. If employees don’t like P2P software, they won’t use it, which puts compliance at risk. This tends to be a feature of newer P2P software.

Airbase’s Guided Procurement module is designed to be an easy front door to spending for employees with its intuitive interface. It solves the problem of multi-stakeholder influence in the purchasing process. Those stakeholders include legal for contract review and sign-off, and IT and InfoSec for compliance and SOC report review.

Best practices in procure-to-pay to overcome challenges.

Implementing best practices in the procure-to-pay (P2P) process flow can significantly improve efficiency, reduce costs, and enhance overall procurement operations. Here are some key procure-to-pay best practices to consider:

Implementing a centralized procurement strategy.

Streamline the requisition and approval process: Automate requisition creation and approval workflows to reduce manual tasks and expedite the procurement cycle. Implement clear approval tiers and ensure timely reviews to prevent delays.

Enforce compliance with policies and regulations: Establish clear procurement policies and procedures to ensure compliance with internal regulations, industry standards, and legal requirements. Implement internal controls to prevent fraud and unauthorized spending.

Establishing clear vendor management guidelines.

Standardize supplier onboarding and management: Establish a centralized supplier database and standardized onboarding procedures to streamline vendor selection and maintain consistent supplier information. Implement supplier performance procure-to-pay evaluation metrics to identify and retain reliable partners.

Optimize sourcing and negotiation strategies: Conduct thorough market research to identify the best suppliers and optimize pricing. Employ negotiation techniques to secure favorable terms and conditions, including volume discounts and early payment incentives.

Implement supplier relationship management (SRM): Establish strong relationships with key suppliers by fostering open communication, regular reviews, and collaboration on performance improvement initiatives. Strong supplier relationships can lead to better pricing, innovation, and supply chain resilience.

Automating purchase order processing.

Use an automated AP management system to automate the PO process: Make sure that both two-way and three-way matching are available to fit your organization’s needs.

Adopt e-invoicing and electronic payments: Implement e-invoicing to automate invoice processing, reduce manual data entry, and eliminate paper-based processes. Utilize electronic payment methods to streamline payments and reduce processing costs.

Ensuring strong internal controls.

Leverage technology and automation: Utilize procure-to-pay software to automate tasks, streamline workflows, and gain real-time visibility into the procurement process. Automating data entry, matching invoices to purchase orders, and routing approvals eliminate manual errors and improve efficiency.

Continuous monitoring and improvement: Regularly review and evaluate the P2P process to identify areas for improvement and implement corrective actions. Monitor key performance indicators (KPIs) such as cycle times, costs, and supplier performance to track progress and identify improvement opportunities.

Empower and train employees: Provide training to procurement team members and end users to ensure they understand the P2P process, policies, and software tools. Empower employees to make informed procurement decisions within their authorized limits.

IDC Analyst Spotlight Report

Read IDC’s spotlight report to learn how procurement is being transformed to meet the needs of modern companies.

Jira

Jira  Ironclad

Ironclad  DocuSign

DocuSign  Asana

Asana